Tuesday, August 31, 2010

Economics of Defense Spending

A fantastic (and funny) quote from the article (Defence spending in a time of austerity, The Economist, Aug 26th 2010) :

http://www.economist.com/node/16886851/print

“In a book published in 1983, Norman Augustine, a luminary of the aerospace industry, drafted a series of lighthearted “laws”. In one aphorism, he plotted the exponential growth of unit cost for fighter aircraft since 1910 (see chart 2), and extrapolated it to its absurd conclusion:

“In the year 2054, the entire defence budget will purchase just one aircraft. This aircraft will have to be shared by the Air Force and Navy 3½ days each per week except for leap year, when it will be made available to the Marines for the extra day.””

An interesting point to be made here is that like many major military powers, the US emphasizes (rightly from a strategic perspective) that major weapons system be entirely developed domestically. From an economic standpoint, if you have a captive buyer – the US government (with what sometimes appears to be an unlimited spending capability) – and few suppliers (facing little or no competition), it is a recipe for cost overruns and expensive production.

India Clocks 8.8% Growth in 2010 June Quarter - Economists Not Impressed

India's largely domestic driven economy is the world's second fastest growing major economy.

A good analysis is provided in this interview:

A good analysis is provided in this interview:

Monday, August 30, 2010

China's Lending Boom

Bank of China’s Chief Xiao Gang notes that government directives are not solely responsible for China’s lending boom:

“Profit is the main driving force of banks. Listed banks have shareholders and must pay attention to market value. Money must be made each quarter and each year to improve certain key performance indices, such as return on equity and return on assets. Like listed banks anywhere in the world, these banks must catch the eyes of new investors, and increase returns to existing ones.

In China, because of the non-liberalized interest rate, net interest margins on yuan loans are almost double of that on foreign currency loans in the international market. In such an environment, which bank wouldn’t want to increase its lending? The more banks lend, the more profits they earn. Simple.”

http://www.boc.cn/en/bocinfo/bi1/201008/t20100826_1126757.html

In China, because of the non-liberalized interest rate, net interest margins on yuan loans are almost double of that on foreign currency loans in the international market. In such an environment, which bank wouldn’t want to increase its lending? The more banks lend, the more profits they earn. Simple.”

http://www.boc.cn/en/bocinfo/bi1/201008/t20100826_1126757.html

In a financially repressed environment, where banks don’t have the freedom to set their own interest rates and savers have few options but to invest domestically, the behavior of Chinese state owned banks is not all that surprising.

It is always about incentives.

Source: PBOC via BIS

A Never Ending Debate - What Role Should the State Play in Economic Matters

Today’s NYT has an interesting piece on the increase in government intervention in the Chinese economy:

For a more nuanced take on the role of the state and the role of entrepreneurs in China,

see MIT professor Yasheng Huang’s http://www.wilsonquarterly.com/printarticle.cfm?aid=1573

see MIT professor Yasheng Huang’s http://www.wilsonquarterly.com/printarticle.cfm?aid=1573

Also, check out

See previous post as well.

Fed's Unconventional Policy Options

BBC provides a nice summary of Fed’s unconventional policy options

A brief note on interest rates paid on reserves:

The Federal Reserve began paying interest rates on reserves in late 2008. Originally authorized by the Financial Services Regulatory Relief Act of 2006, interest payments on reserve balances held (by depository institutions) at Reserve Banks was to begin in 2011. But, the effective date was advanced to October 2008 in response to the financial crisis by the Emergency Economic Stabilization Act of 2008.

Interest rate paid on required reserves is aimed at eliminating the implicit tax that reserve requirements imposed on depository institutions. Interest rate paid on excess reserves is actually a new policy tool available to the Federal Reserve. By varying interest rate on excess reserves, the Fed can potentially influence the quantity of excess reserves banks choose to hold (as opposed to lending it out).

Currently, interest rates on required reserve balances and on excess reserve balances have been set by the Federal Reserve Board at 25 basis points.

Barro on Unemployment Insurance

Harvard economist, Robert Barro, notes in his WSJ op-ed

(http://online.wsj.com/article/SB10001424052748703959704575454431457720188.html):

"In a recession, it is more likely that individual unemployment reflects weak economic conditions, rather than individual decisions to choose leisure over work. Therefore, it is reasonable during a recession to adopt a more generous unemployment-insurance program. In the past, this change entailed extensions to perhaps 39 weeks of eligibility from 26 weeks, though sometimes a bit more and typically conditioned on the employment situation in a person's state of residence. However, we have never experienced anything close to the blanket extension of eligibility to nearly two years. We have shifted toward a welfare program that resembles those in many Western European countries".

These previous posts also deal with the issue of unemployment insurance

(http://online.wsj.com/article/SB10001424052748703959704575454431457720188.html):

"In a recession, it is more likely that individual unemployment reflects weak economic conditions, rather than individual decisions to choose leisure over work. Therefore, it is reasonable during a recession to adopt a more generous unemployment-insurance program. In the past, this change entailed extensions to perhaps 39 weeks of eligibility from 26 weeks, though sometimes a bit more and typically conditioned on the employment situation in a person's state of residence. However, we have never experienced anything close to the blanket extension of eligibility to nearly two years. We have shifted toward a welfare program that resembles those in many Western European countries".

These previous posts also deal with the issue of unemployment insurance

Sunday, August 29, 2010

Is China a Challenger to US High Tech Leadership?

http://www.cnbc.com/id/15840232?video=1569316261&play=1

Also, check out:

http://online.wsj.com/article/SB10001424052748703428604575418680197041878.html

Interesting fact from the WSJ article ("In Toledo, the 'Glass City,' New Label: Made in China")

"China makes 45% of the world's glass, but it consumes virtually all of that amount. Every 15 minutes, its production is enough to clad a 100-story skyscraper".

A factor hindering US exports are the highly restrictive export controls (regulations that restrict sales of particular goods abroad for national security reasons). You cannot expect US companies to increase their exports significantly if they are not allowed to sell goods that foreigners actually want to buy.

http://online.wsj.com/article/SB10001424052748703959704575454313481209990.html

Also, check out:

http://online.wsj.com/article/SB10001424052748703428604575418680197041878.html

Interesting fact from the WSJ article ("In Toledo, the 'Glass City,' New Label: Made in China")

"China makes 45% of the world's glass, but it consumes virtually all of that amount. Every 15 minutes, its production is enough to clad a 100-story skyscraper".

A factor hindering US exports are the highly restrictive export controls (regulations that restrict sales of particular goods abroad for national security reasons). You cannot expect US companies to increase their exports significantly if they are not allowed to sell goods that foreigners actually want to buy.

http://online.wsj.com/article/SB10001424052748703959704575454313481209990.html

IMD’s THE WORLD COMPETITIVENESS SCOREBOARD 2010

A Picture is worth a Thousand Words…

From Denver Post’s extraordinary photo blog collection

Awesome Photos of China (present day)

Morning traffic in China's Chongqing municipality; Chinese car sales are projected to exceed 15 million units in 2010. China became the largest auto market in the world (in terms of units sold) in 2009. (source: http://blogs.denverpost.com/captured/2010/08/09/in-focus-china-economy/2378/)

Also, check out:

New York from Above

Rare Color Photos – United States (circa 1939)

Investing in Stock Markets

Is it time to get back into stocks?

Roger Lowenstein appears to think it is time to invest in stocks. In an article in the NY Times Sunday Magazine, he states

“Stocks are simply a claim on future corporate earnings: if you can buy those claims at a discount, you should do well. Wise men will disagree on the meaning of “at a discount.” But American business is profitable even today. And the Standard & Poor’s 500 stock index is trading at only 12 times the expected earnings of the underlying stocks over the next year. Inverting that ratio, stocks have an earnings yield of 8.5 percent. (Each $100 of stocks is backed by $8.50 of expected earnings.)”

(http://www.nytimes.com/2010/08/29/magazine/29fob-wwln-t.html)

Also, see previous post related to this issue

Meanwhile, on the lack of clear policy prescriptions for US economic malaise, see:

Austrian School of Economics

The WSJ profiles Peter J. Boettke, a follower of the Austrian School of Economics

An interesting paper by Peter J. Boettke is What Happened to “Efficient Markets”?, The Independent Review, v. 14, n. 3, Winter 2010

The paper provides an interesting perspective on the debate regarding the efficacy of free markets that arose in the aftermath of the financial crisis.

Relatedly,

An interesting piece in the New Yorker on the complexities of libertarian politics in the US:

http://www.newyorker.com/reporting/2010/08/30/100830fa_fact_mayer?printable=true

Relatedly,

An interesting piece in the New Yorker on the complexities of libertarian politics in the US:

http://www.newyorker.com/reporting/2010/08/30/100830fa_fact_mayer?printable=true

Friday, August 27, 2010

Key Economic Policy Debates

New York Times’ David Brooks get in on the Germany-US debate

http://www.nytimes.com/2010/08/27/opinion/27brooks.html

Also, see previous post related to the Germany-US crisis response debate

Also, see previous post related to the Germany-US crisis response debate

A debate between Paul Krugman and Douglas Holtz-Eakin on whether the Fed needs to do more for the economy (no surprises as to what Krugman wants)

BRICs - NBR Reports

BRICs

Nightly Business Report’s brief business news segments on the BRIC nations:

Brazil

Russia

India

China

Also, check out the following China related items:

China faces challenges of fast growth

(When a traffic gridlock gets its own name - The Great Chinese Gridlock of 2010 - and stretches for 100 km, you know its bad)

Are Chinese Women More Ambitious Than Their US Counterparts?

Shopping in China

More on the Fed Policy

Bernanke's take on the economy and monetary policy

http://www.federalreserve.gov/newsevents/speech/bernanke20100827a.pdf

Treasury bond market reaction to Bernanke's comments:

http://www.bloomberg.com/news/print/2010-08-27/treasury-10-year-notes-poised-for-weekly-advance-as-economic-growth-slows.html

Brief Analysis of Bernanke's speech

http://www.federalreserve.gov/newsevents/speech/bernanke20100827a.pdf

Treasury bond market reaction to Bernanke's comments:

http://www.bloomberg.com/news/print/2010-08-27/treasury-10-year-notes-poised-for-weekly-advance-as-economic-growth-slows.html

Brief Analysis of Bernanke's speech

US GDP Revisions for 2010 Q2

Source: BEA

A note on revisions:

A note on revisions:

- BEA makes three successive current quarterly estimates of GDP - (1) advance (2) preliminary, and (3) final.

- Also, Each July annual revisions are released for the estimates of quarterly GDP for the three previous years; these annual revisions are labeled “first,” “second,” and “third” annual estimates.

Thursday, August 26, 2010

Fed - Money Magic

How the Federal Reserve bought $1.25 trillion (or more accurately $1,249,999,999,999.39) of mortgage-backed bonds: http://www.npr.org/blogs/money/2010/08/26/129451895/how-to-spend-1-25-trillion

Interesting highlight:

“The Fed was able to spend so much money so quickly because it has a unique power: It can create money out of thin air, whenever it decides to do so. So, … the mortgage team would decide to buy a bond, they’d push a button on the computer — "and voila, money is created."”

Also, the Fed's near zero interest rate policy is not cost free and dangerous in the long-run

http://freakonomics.blogs.nytimes.com/2010/08/25/why-we-should-exit-ultra-low-rates-a-guest-post-by-raghuram-rajan/?pagemode=print

Also, the Fed's near zero interest rate policy is not cost free and dangerous in the long-run

http://freakonomics.blogs.nytimes.com/2010/08/25/why-we-should-exit-ultra-low-rates-a-guest-post-by-raghuram-rajan/?pagemode=print

Dangers of Extrapolating Results from Experiments (Based on a Narrow Group of Subjects)

A Note of Caution for Experimental Psychologists and Economists

On International Affairs

A Failing State …

Wither the Special Relation … (Probably a Good Thing for UK)

American Power

Wednesday, August 25, 2010

Jobs of the Future

Economist Richard Florida (author of The Rise of the Creative Class & The Flight of the Creative Class) examines the projected distribution of jobs in the US:

Metros expected to show the biggest job growth between 2010 and 2018:

(Source: http://www.theatlantic.com/business/print/2010/08/where-the-jobs-will-be/61459/ )

Also, see

Blue Collar Jobs

http://www.theatlantic.com/business/print/2010/08/where-the-blue-collar-jobs-will-be/61463/

Service Jobs:

http://www.theatlantic.com/business/print/2010/08/where-service-jobs-will-be/61465/

Creative Class Jobs:

http://www.theatlantic.com/business/print/2010/08/where-the-creative-class-jobs-will-be/61468/

Metros expected to show the biggest job growth between 2010 and 2018:

(Source: http://www.theatlantic.com/business/print/2010/08/where-the-jobs-will-be/61459/ )

Also, see

Blue Collar Jobs

http://www.theatlantic.com/business/print/2010/08/where-the-blue-collar-jobs-will-be/61463/

Service Jobs:

http://www.theatlantic.com/business/print/2010/08/where-service-jobs-will-be/61465/

Creative Class Jobs:

http://www.theatlantic.com/business/print/2010/08/where-the-creative-class-jobs-will-be/61468/

Public Finances and Fiscal Policies

Should the Bush Taxes Be Allowed to Expire?

http://www.ft.com/cms/s/0/41ed6e4c-afad-11df-b45b-00144feabdc0.html

Is the US Treasury Bond Market Experiencing a Bubble?

http://www.bloomberg.com/news/print/2010-08-24/asset-bubble-addicts-just-can-t-shake-habit-commentary-by-caroline-baum.html

Fixing Social Security

http://www.bloomberg.com/news/print/2010-08-25/retiree-ponzi-scheme-is-16-trillion-short-laurence-kotlikoff.html

Keynesian or Not – The Debate Continues

http://www.bloomberg.com/news/print/2010-08-23/bury-keynesian-voodoo-before-it-can-bury-us-all-kevin-hassett.html

http://krugman.blogs.nytimes.com/2010/08/24/what-about-germany/

International:

Irish Debt Gets Downgraded

http://www.nytimes.com/2010/08/26/business/global/26punt.html

Greece can learn from Brazil’s Experience

http://www.ft.com/cms/s/0/39c1f9ea-afad-11df-b45b-00144feabdc0.html

http://www.ft.com/cms/s/0/41ed6e4c-afad-11df-b45b-00144feabdc0.html

Is the US Treasury Bond Market Experiencing a Bubble?

http://www.bloomberg.com/news/print/2010-08-24/asset-bubble-addicts-just-can-t-shake-habit-commentary-by-caroline-baum.html

Fixing Social Security

http://www.bloomberg.com/news/print/2010-08-25/retiree-ponzi-scheme-is-16-trillion-short-laurence-kotlikoff.html

Keynesian or Not – The Debate Continues

http://www.bloomberg.com/news/print/2010-08-23/bury-keynesian-voodoo-before-it-can-bury-us-all-kevin-hassett.html

http://krugman.blogs.nytimes.com/2010/08/24/what-about-germany/

International:

Irish Debt Gets Downgraded

http://www.nytimes.com/2010/08/26/business/global/26punt.html

Greece can learn from Brazil’s Experience

http://www.ft.com/cms/s/0/39c1f9ea-afad-11df-b45b-00144feabdc0.html

Tuesday, August 24, 2010

Intel's CEO discusses America's Leadership Position in the Technology Arena

Intel's CEO Paul Otellini and others engage in an interesting discussion on several key issues including US technological lead, US economic future, and the global economy

Video link

http://www.aspeninstitute.org/video/roundtable-paul-s-otellini

Video link

http://www.aspeninstitute.org/video/roundtable-paul-s-otellini

Discord at the Fed

Sharp debate among Fed policymakers in regards to the way the central bank manages its huge portfolio of securities

http://online.wsj.com/article/SB10001424052748703589804575446262796725120.html

http://online.wsj.com/article/SB10001424052748703589804575446262796725120.html

Developments in the Global Economy

Japanese Yen hits a 15 year high

http://www.bloomberg.com/news/print/2010-08-24/kan-says-yen-moves-undesirable-as-union-urges-g-7-action-to-curb-rise.html

(Also, the Nikkei index is below 9000 (again))

(Also, the Nikkei index is below 9000 (again))

Yen-dollar rate during the past decade

A small open-economy – New Zealand – throws up interesting policy challenges

Wild Swings in the Kiwi-US Dollar rate during the past decade

China – the new high-speed train superpower

Monday, August 23, 2010

Monetary Policy Challenges

Japan Struggles with Long-Term Deflation

http://www.nytimes.com/2010/08/24/business/global/24deflate.html

Raghuram Rajan Recommends the Fed Shift Away From ZIRP (Zero Interest Rate Policy) soon

http://www.bloomberg.com/news/print/2010-08-22/bernanke-must-raise-benchmark-2-points-in-prescient-rajan-s-latest-warning.html

Meanwhile, Paul Krugman suggests that near zero interest rates are here to stay (for a really long time):

http://krugman.blogs.nytimes.com/2010/08/22/the-taylor-rule-and-the-bond-bubble-wonkish/

http://www.nytimes.com/2010/08/24/business/global/24deflate.html

Raghuram Rajan Recommends the Fed Shift Away From ZIRP (Zero Interest Rate Policy) soon

http://www.bloomberg.com/news/print/2010-08-22/bernanke-must-raise-benchmark-2-points-in-prescient-rajan-s-latest-warning.html

Meanwhile, Paul Krugman suggests that near zero interest rates are here to stay (for a really long time):

http://krugman.blogs.nytimes.com/2010/08/22/the-taylor-rule-and-the-bond-bubble-wonkish/

Asset Markets - Long-Term Impact of the Crisis

Real Estate Investment - No Longer a One Way Bet.

http://www.nytimes.com/2010/08/23/business/economy/23decline.html

Small Investors Avoid Stocks

http://www.nytimes.com/2010/08/22/business/22invest.html

Also, Debt Reduction Among US Households

http://www.nytimes.com/2010/08/22/business/22gret.html

http://www.nytimes.com/2010/08/23/business/economy/23decline.html

Small Investors Avoid Stocks

http://www.nytimes.com/2010/08/22/business/22invest.html

Also, Debt Reduction Among US Households

http://www.nytimes.com/2010/08/22/business/22gret.html

Sunday, August 22, 2010

Interesting Economic Research

Does Income Inequality Cause Financial Crises?

Are Business Forecasters Over-Confident?

Saturday, August 21, 2010

Thursday, August 19, 2010

The latest from the Congressional Budget Office

CBO’s THE BUDGET AND ECONOMIC OUTLOOK: AN UPDATE - AUGUST 2010

Highlights include:

Budget deficit for 2010 will exceed $1.3 trillion

Source: Congressional Budget Office (http://www.cbo.gov)

History of World GDP

Great Graphic: http://www.economist.com/node/16834943

Economist Cover Story

China v. India

Also, see

Yasheng Huang and Tarun Khanna’s ""Can India overtake China?", Foreign Policy, July/August 2003

and,

Yasheng Huang’s "The Next Asian Miracle," Foreign Policy, July/August, 2008.

Global Cities

Will Cities Rule the World?

Beyond City Limits: The age of nations is over. The new urban age has begun. By Parag Khanna | Foreign Policy, SEPT. / OCT. 2010

The 2010 Global Cities Index

The World's Wannabe Silicon Valleys

Foreign Policy, SEPT. / OCT. 2010

Early Economic Development in Germany and the US

Did the lack of copyright laws propel Germany's rapid 19th century industrialization?

http://www.spiegel.de/international/zeitgeist/0,1518,druck-710976,00.html

As far as early US experience is concerned, here is an interesting piece by historian Stephen Mihm:

http://www.boston.com/news/globe/ideas/articles/2007/08/26/a_nation_of_outlaws?mode=PF

http://www.spiegel.de/international/zeitgeist/0,1518,druck-710976,00.html

As far as early US experience is concerned, here is an interesting piece by historian Stephen Mihm:

http://www.boston.com/news/globe/ideas/articles/2007/08/26/a_nation_of_outlaws?mode=PF

Wednesday, August 18, 2010

Global Economic Issues

China appears to be getting serious about diversifying its forex reserves. There is increasing preference amongst the Chinese authorities for JGB (Japanese Government Bonds), Euro-zone Bonds, and now South Korean Bonds. If the Chinese shift (away from US treasuries) is part of a secular long-term strategy, it might have repercussions for US fiscal policymakers down the road (especially in a year or two when ‘flight to safety’ is no longer the primary driver of investment strategies)

Germany gets criticized for being successful

http://www.bloomberg.com/news/2010-08-17/germany-ignores-soros-as-exports-drive-record-growth-at-consumers-expense.html

http://www.bloomberg.com/news/2010-08-17/germany-ignores-soros-as-exports-drive-record-growth-at-consumers-expense.html

As even some economists appear to be forgetting the basics of international trade these days, it is refreshing to see Prof. Bhagwati offer some much needed straight talk on free trade:

India's Auto Sector

India’s Auto Sector Boom

Rapid increase in demand for cars in India is creating unexpected challenges for automakers/auto parts suppliers – parts shortages, capacity constraints and customers being waitlisted.

Tata’s much criticized acquisition of JLR (Jaguar & Land Rover) is now starting to look like a winner

A Good Metaphor for the Current Policy Debate

Richard Cookson in a Financial Times piece ("The Fed wavers as the world gets the sweats", 8/18/2010) states:

"If you diagnosed the horrific financial crisis at the end of 2008 and early 2009 as a temporary depression, the prescription was clear: vast amounts of antidepressants in the form of the biggest fiscal and monetary stimulus the world has seen. Eventually the patient would feel cheerier and the world a brighter place. In time, it could be weaned off the medicine. If, in contrast, you thought growth had been powered by an unsustainable rise in debt, then a different metaphor for the stimulus seems apposite: giving methadone to a heroin addict. The effects of the medication would be transitory and the patient would at some point have to go cold turkey".

How should the Fed respond to current economic conditions?

The Economist conducts a debate involving a few prominent economists:

http://www.economist.com/economics/by-invitation/questions/what_actions_should_fed_be_taking

How should the Fed respond to current economic conditions?

The Economist conducts a debate involving a few prominent economists:

http://www.economist.com/economics/by-invitation/questions/what_actions_should_fed_be_taking

Book Recommendations

Book Recommendations:

Topic - Financial Crisis

Restoring Financial Stability: How to Repair a Failed System (Wiley Finance) - by New York University Stern School of Business, (Editors: Viral Acharya, and Matthew Richardson)

Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System--and Themselves by Andrew Ross Sorkin

The Big Short: Inside the Doomsday Machine by Michael Lewis

Financial Fiasco: How America's Infatuation with Home Ownership and Easy Money Created the Economic Crisis by Johan Norberg

Getting Off Track: How Government Actions and Interventions Caused, Prolonged, and Worsened the Financial Crisis (Hoover Institution Press Publication) by John B. Taylor

In FED We Trust: Ben Bernanke's War on the Great Panic by David Wessel

The Holy Grail of Macroeconomics: Lessons from Japans Great Recession by Richard Koo

Topic - Economic History & Thought

Lords of Finance: The Bankers Who Broke the World by Liaquat Ahamed

This Time Is Different: Eight Centuries of Financial Folly by Carmen Reinhart and Kenneth Rogoff

The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall Street by Justin Fox

How Markets Fail: The Logic of Economic Calamities by John Cassidy

Prophet of Innovation: Joseph Schumpeter and Creative Destruction by Thomas K. McCraw

The Great Inflation and Its Aftermath: The Past and Future of American Affluence by Robert J. Samuelson

Topic - International Affairs

The Icarus Syndrome by Peter Beinart

Asian Juggernaut by Brahma Chellaney

The New Asian Hemisphere by Kishore Mahbubani

Tuesday, August 17, 2010

US Economy - Update

Two Pieces of Good News:

US Manufacturing - A Bright Spot

http://www.bloomberg.com/news/print/2010-08-17/industrial-production-in-u-s-increased-by-1-last-month-double-forecasts.html

American Household Debt Declines

http://www.bloomberg.com/news/print/2010-08-17/household-debt-in-u-s-shrank-last-quarter-as-consumers-cut-back-fed-says.html

Two prominent economists offer their opinions on the US economy:

Narayana Kocherlakota - President of Federal Reserve Bank of Minneapolis:

http://www.minneapolisfed.org/news_events/pres/kocherlakota_speech_08172010.pdf

Gary Becker - Nobel Prize winning Economist:

http://www.becker-posner-blog.com/2010/08/the-slowdown-in-the-economic-recovery-becker.html

US Manufacturing - A Bright Spot

http://www.bloomberg.com/news/print/2010-08-17/industrial-production-in-u-s-increased-by-1-last-month-double-forecasts.html

American Household Debt Declines

http://www.bloomberg.com/news/print/2010-08-17/household-debt-in-u-s-shrank-last-quarter-as-consumers-cut-back-fed-says.html

Two prominent economists offer their opinions on the US economy:

Narayana Kocherlakota - President of Federal Reserve Bank of Minneapolis:

http://www.minneapolisfed.org/news_events/pres/kocherlakota_speech_08172010.pdf

Gary Becker - Nobel Prize winning Economist:

http://www.becker-posner-blog.com/2010/08/the-slowdown-in-the-economic-recovery-becker.html

Gary Becker on Germany-US Crisis Response

http://www.becker-posner-blog.com/2010/08/germany-vs-us-two-different-approaches-to-the-recession-becker.html

Also see my previous post on this issue

Also see my previous post on this issue

Monday, August 16, 2010

Boomers Cutback Spending

An interesting article from today's WSJ:

http://online.wsj.com/article/SB10001424052748703321004575427881929070948.html

http://online.wsj.com/article/SB10001424052748703321004575427881929070948.html

Unemployment Insurance and Job Search Intensity

A fascinating case study:

http://economix.blogs.nytimes.com/2010/08/16/why-denmark-is-shrinking-its-social-safety-net/

As US policymakers debate and implement multiple extensions to the unemployment benefits program (in some cases, benefits have been extended to 99 weeks instead of the normal 26 weeks), the Danish experience might be worth examining.

http://economix.blogs.nytimes.com/2010/08/16/why-denmark-is-shrinking-its-social-safety-net/

As US policymakers debate and implement multiple extensions to the unemployment benefits program (in some cases, benefits have been extended to 99 weeks instead of the normal 26 weeks), the Danish experience might be worth examining.

China

China overtakes Japan to become the second largest economy (in terms of market exchange rates) in the world. It was already the second largest economy in terms of purchasing power parity exchange rates.

http://www.bloomberg.com/news/2010-08-16/china-economy-passes-japan-s-in-second-quarter-capping-three-decade-rise.html

China reconsiders its dollar reserve holdings

http://www.bloomberg.com/news/2010-08-15/china-favors-euros-over-dollars-as-bernanke-shifts-course-on-fed-stimulus.html

http://www.bloomberg.com/news/2010-08-16/china-economy-passes-japan-s-in-second-quarter-capping-three-decade-rise.html

China reconsiders its dollar reserve holdings

http://www.bloomberg.com/news/2010-08-15/china-favors-euros-over-dollars-as-bernanke-shifts-course-on-fed-stimulus.html

Sunday, August 15, 2010

Why Hong Kong Needs to Abandon its Currency Board

One of the fundamental challenges faced by adopters of a fixed or pegged exchange rate system is the loss of monetary independence (except in cases where draconian capital controls are implemented): that is, if you (a foreign country) peg to the dollar then your monetary policy is essentially at the mercy of the US Federal Reserve. Given Fed's love affair with ultra-low interest rates, this can be hazardous for fast growing economies like Hong Kong. Hong Kong is also attracting significant investments from rich mainland Chinese eager to acquire property (and establish residency in HK).

Hong Kong pursues an extreme form of a fixed exchange rate regime, typically called a currency board. (Hong Kong calls its exchange rate system the linked exchange rate system). Like any currency board arrangement, the domestic monetary base is fully backed by foreign reserves. Changes in the size of the monetary base require corresponding changes to foreign reserve holdings. While such systems are preferable in countries trying to stem frequent bouts of high inflation, it appears increasingly inappropriate for an advanced economy like Hong Kong.

Given the growing interdependence with the Chinese mainland, it makes one wonder if the better choice for Hong Kong would be to abandon the HK dollar and adopt the renminbi. As the renminbi increases its international profile and shifts towards a floating rate system, Hong Kong would be better served by adopting the Chinese currency. Frankly, it appears inevitable that at some point in time the HK dollar will cease to exist.

http://blogs.wsj.com/economics/2010/08/13/hong-kong-forced-to-fight-the-fed-again/tab/print/

Hong Kong pursues an extreme form of a fixed exchange rate regime, typically called a currency board. (Hong Kong calls its exchange rate system the linked exchange rate system). Like any currency board arrangement, the domestic monetary base is fully backed by foreign reserves. Changes in the size of the monetary base require corresponding changes to foreign reserve holdings. While such systems are preferable in countries trying to stem frequent bouts of high inflation, it appears increasingly inappropriate for an advanced economy like Hong Kong.

Given the growing interdependence with the Chinese mainland, it makes one wonder if the better choice for Hong Kong would be to abandon the HK dollar and adopt the renminbi. As the renminbi increases its international profile and shifts towards a floating rate system, Hong Kong would be better served by adopting the Chinese currency. Frankly, it appears inevitable that at some point in time the HK dollar will cease to exist.

http://blogs.wsj.com/economics/2010/08/13/hong-kong-forced-to-fight-the-fed-again/tab/print/

US Economy - Interesting Issues

Jumpstarting US Manufacturing

Inflation – Measurement Issues

http://blogs.wsj.com/economics/2010/08/14/number-of-the-week-insults-and-injury-for-renters/tab/print/

Tax Breaks - Mortgage Interest Rates

Tax Breaks - Mortgage Interest Rates

(A provocative, yet economically rational, idea would be to get rid of mortgage interest rate tax deductions; it is in fact the costliest tax break in the US)

Equity Markets

The ‘Hindenberg Omen’

(Never heard of it until this week; I am not typically a fan of technical trading)

The world’s largest first-time share sale

(Chinese IPOs have dominated the global IPO market the last three years)

Saturday, August 14, 2010

Finance - Equity Markets

Here is a thought-provoking piece: "The Great Stock Myth" by Megan Mcardle of The Atlantic.

http://www.theatlantic.com/magazine/print/2010/09/the-great-stock-myth/8178/

A section of the article deals with the "equity premium puzzle". As noted by Megan Mcardle, "[s]ince the late 19th century, stock investments in America had generated returns that were 6 percent higher than what economists call “the risk-free rate"—the yield on an investment for which there is virtually no risk of losing your principal. The low-risk investments, such as short-term U.S. government debt, had yielded less than 1 percent.Those “excess” stock-market returns, which include both price appreciation and dividends, are much higher than you would expect if they simply reflected the risk of losing your investment"

However, as many of us have come to realize, the return on equities during the past decade has been woeful. This has led some to wonder whether equity premium may be shrinking or even disappearing.

Meanwhile, Bill Gross and Mohamed El-Erian of Pimco apparently prefer stocks over bonds:

http://www.bloomberg.com/news/print/2010-06-24/gross-vows-this-time-different-with-el-erian-leading-push-in-global-stocks.html

Are financial markets different from goods markets?

http://www.economist.com/node/16792858?story_id=16792858&CFID=145057713&CFTOKEN=71578004

http://www.theatlantic.com/magazine/print/2010/09/the-great-stock-myth/8178/

A section of the article deals with the "equity premium puzzle". As noted by Megan Mcardle, "[s]ince the late 19th century, stock investments in America had generated returns that were 6 percent higher than what economists call “the risk-free rate"—the yield on an investment for which there is virtually no risk of losing your principal. The low-risk investments, such as short-term U.S. government debt, had yielded less than 1 percent.Those “excess” stock-market returns, which include both price appreciation and dividends, are much higher than you would expect if they simply reflected the risk of losing your investment"

However, as many of us have come to realize, the return on equities during the past decade has been woeful. This has led some to wonder whether equity premium may be shrinking or even disappearing.

Meanwhile, Bill Gross and Mohamed El-Erian of Pimco apparently prefer stocks over bonds:

http://www.bloomberg.com/news/print/2010-06-24/gross-vows-this-time-different-with-el-erian-leading-push-in-global-stocks.html

Are financial markets different from goods markets?

http://www.economist.com/node/16792858?story_id=16792858&CFID=145057713&CFTOKEN=71578004

Friday, August 13, 2010

PIMCO Adjusts its Portfolio

The world's largest bond fund makes an interesting move:

http://www.businessweek.com/news/2010-08-13/pimco-cuts-government-debt-boosts-emerging-markets.html

http://www.businessweek.com/news/2010-08-13/pimco-cuts-government-debt-boosts-emerging-markets.html

Engineering Innovations

Mobile phones are revolutionizing business activities in many emerging markets. Given the often poor availability of landlines, the dramatic growth of the mobile phone sector has been a godsend for developing countries. Here is an interesting story from The Economist:

http://economist.com/blogs/babbage/2010/08/jugaad

For a technical study on the impact of mobile phones on the agriculture sector, see

Socio-Economic Impact of Mobile Phones on Indian Agriculture (February 2010) by Surabhi Mittal, Sanjay Gandhi, & Gaurav Tripathi

http://www.icrier.org/pdf/WorkingPaper246.pdf

http://economist.com/blogs/babbage/2010/08/jugaad

For a technical study on the impact of mobile phones on the agriculture sector, see

Socio-Economic Impact of Mobile Phones on Indian Agriculture (February 2010) by Surabhi Mittal, Sanjay Gandhi, & Gaurav Tripathi

http://www.icrier.org/pdf/WorkingPaper246.pdf

Global Growth Update

From the BBC:

http://www.bbc.co.uk/news/business-10965077

Note: The growth rate data is reported here on a quarterly on quarter growth rate basis (not reported as quarterly growth rate on an annualized basis as is common practice in the US)

http://www.bbc.co.uk/news/business-10965077

Note: The growth rate data is reported here on a quarterly on quarter growth rate basis (not reported as quarterly growth rate on an annualized basis as is common practice in the US)

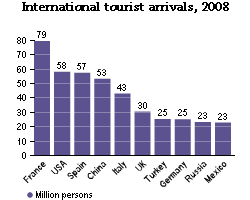

International Tourism

France gets the most tourists ...

Source: http://blog.oecdfactblog.org/?p=125

but, the US gets the most tourist dollars

Source:http://blog.oecdfactblog.org/?p=139

India - Neat Videos

Incredible India Tourism Ad,

Source: http://blog.oecdfactblog.org/?p=125

but, the US gets the most tourist dollars

Source:http://blog.oecdfactblog.org/?p=139

India - Neat Videos

Incredible India Tourism Ad,

Federal Reserve's Sole Dissenting Voice

Federal Reserve Bank of Kansas City President Thomas Hoenig (and current FOMC voting member) wants the Fed to shift away from its ZIRP (zero interest rate policy).

http://www.kansascityfed.org/speechbio/Hoenigpdf/Bartlesville.06.03.10.pdf

http://www.kansascityfed.org/speechbio/Hoenigpdf/Bartlesville.06.03.10.pdf

European Economy

Europe's largest economy, Germany, reported stellar growth figures for 2010 Q2. In fact, Germany recorded the fastest quarterly growth in 2010 Q2 since reunification.

http://www.spiegel.de/international/germany/0,1518,druck-711679,00.html

It is worth recalling that several US economists (especially Paul Krugman) criticized Germany for its limited fiscal response to the Global Credit Crisis of 2008-2009. See for instance:

http://krugman.blogs.nytimes.com/2008/12/11/the-economic-consequences-of-herr-steinbrueck/?pagemode=print

or http://www.spiegel.de/international/business/0,1518,701894,00.html

It appears, at least based on recent performance, that Germany and Angela Merkel have been vindicated as far as their adoption of a measured response to the crisis is concerned.

Euro-related Issues:

The Future of the Euro

http://www.foreignaffairs.com/print/66483

George Soro's on the euro-zone sovereign debt crisis:

http://www.nybooks.com/articles/archives/2010/aug/19/crisis-euro/?pagination=false

http://www.spiegel.de/international/germany/0,1518,druck-711679,00.html

It is worth recalling that several US economists (especially Paul Krugman) criticized Germany for its limited fiscal response to the Global Credit Crisis of 2008-2009. See for instance:

http://krugman.blogs.nytimes.com/2008/12/11/the-economic-consequences-of-herr-steinbrueck/?pagemode=print

or http://www.spiegel.de/international/business/0,1518,701894,00.html

It appears, at least based on recent performance, that Germany and Angela Merkel have been vindicated as far as their adoption of a measured response to the crisis is concerned.

Euro-related Issues:

The Future of the Euro

http://www.foreignaffairs.com/print/66483

George Soro's on the euro-zone sovereign debt crisis:

http://www.nybooks.com/articles/archives/2010/aug/19/crisis-euro/?pagination=false

Thursday, August 12, 2010

More on the Fiscal Austerity or Stimulus Debate

From the Economist,

http://www.economist.com/node/16792828?story_id=16792828

From the Federal Reserve Bank at Dallas,

http://www.dallasfed.org/research/eclett/2010/el1008.pdf

Harvard's Alberto Alesina has a brief article on the subject:

http://www.economics.harvard.edu/faculty/alesina/files/Fiscal%2BAdjustments_lessons.pdf

(see my previous post as well)

http://www.economist.com/node/16792828?story_id=16792828

From the Federal Reserve Bank at Dallas,

http://www.dallasfed.org/research/eclett/2010/el1008.pdf

Harvard's Alberto Alesina has a brief article on the subject:

http://www.economics.harvard.edu/faculty/alesina/files/Fiscal%2BAdjustments_lessons.pdf

(see my previous post as well)

Inflation vs. Deflation Debate

There is increasing chatter about the risk of deflation in the US. For instance, see

http://research.stlouisfed.org/econ/bullard/pdf/SevenFacesFinalJul28.pdf

In emerging markets, however, inflation is a primary concern right now. Will higher inflation in China and the rest of East Asia impact the US? International transmission of inflation is not particularly well understood. Here is an interesting example:

http://blogs.wsj.com/economics/2010/08/12/china-labor-cost-increases-setting-the-bar-for-other-economies/

http://research.stlouisfed.org/econ/bullard/pdf/SevenFacesFinalJul28.pdf

In emerging markets, however, inflation is a primary concern right now. Will higher inflation in China and the rest of East Asia impact the US? International transmission of inflation is not particularly well understood. Here is an interesting example:

http://blogs.wsj.com/economics/2010/08/12/china-labor-cost-increases-setting-the-bar-for-other-economies/

A Sobering Viewpoint on US Long-Term Fiscal Balances

Boston University economist Laurence Kotlikoff provides a scary diagnosis of the fiscal health of the US:

http://www.bloomberg.com/news/print/2010-08-11/u-s-is-bankrupt-and-we-don-t-even-know-commentary-by-laurence-kotlikoff.html

While much of the current debate revolves around the viability of a second round of stimulus, it may be worth considering the advantages of tackling the longer-term challenges posed by entitlement spending. Restoring confidence regarding the long-term fiscal health of the US can provide tremendous relief to financial markets (and businesses as well).

The current 'flight to safety' aspect that is pushing US treasury yields lower is not likely to last forever. In fact, one wonders about the sanity of financial market participants when JGB (Japanese Government Bonds) and US treasury bonds are considered the safest assets. Japan's government debt to GDP ratio is already around 200%. It faces serious demographic challenges (see previous post). The US, meanwhile, has to deal with serious political and structural challenges that inhibit the ability of the government to reign in entitlement spending (all 78 million or so baby boomers will be eligible for social security and medicare in little more than a decade). Potential growth rates for both Japan and the US are likely to be lower in the near to medium term as well.

What is likely to happen as continuing financial deepening (especially the further development of bond markets) in emerging markets creates real alternatives for global bond investors?

Currently, all three major rating agencies (Moody's, S&P, and Fitch) are based in the West (US & Europe). The performance of the major rating agencies during the past decade has been woeful at best. They certainly bear some culpability for the recent financial crisis. China is promoting a new challenger - Dagong International Credit Rating Company. It's views on sovereign debt ratings are quite different from that of Moody's, S&P, and Fitch.

http://www.eastasiaforum.org/2010/07/18/china-scores-an-a-says-beijings-credit-rating-agency/print/

http://www.bloomberg.com/news/print/2010-08-11/u-s-is-bankrupt-and-we-don-t-even-know-commentary-by-laurence-kotlikoff.html

While much of the current debate revolves around the viability of a second round of stimulus, it may be worth considering the advantages of tackling the longer-term challenges posed by entitlement spending. Restoring confidence regarding the long-term fiscal health of the US can provide tremendous relief to financial markets (and businesses as well).

The current 'flight to safety' aspect that is pushing US treasury yields lower is not likely to last forever. In fact, one wonders about the sanity of financial market participants when JGB (Japanese Government Bonds) and US treasury bonds are considered the safest assets. Japan's government debt to GDP ratio is already around 200%. It faces serious demographic challenges (see previous post). The US, meanwhile, has to deal with serious political and structural challenges that inhibit the ability of the government to reign in entitlement spending (all 78 million or so baby boomers will be eligible for social security and medicare in little more than a decade). Potential growth rates for both Japan and the US are likely to be lower in the near to medium term as well.

What is likely to happen as continuing financial deepening (especially the further development of bond markets) in emerging markets creates real alternatives for global bond investors?

Currently, all three major rating agencies (Moody's, S&P, and Fitch) are based in the West (US & Europe). The performance of the major rating agencies during the past decade has been woeful at best. They certainly bear some culpability for the recent financial crisis. China is promoting a new challenger - Dagong International Credit Rating Company. It's views on sovereign debt ratings are quite different from that of Moody's, S&P, and Fitch.

http://www.eastasiaforum.org/2010/07/18/china-scores-an-a-says-beijings-credit-rating-agency/print/

Wednesday, August 11, 2010

Two-Track Global Economy

As fears about the pace of the global economic recovery increase, the following poll shows that conditions on the ground vary significantly. How you feel about the economy depends on where you are located.

http://www.ipsos-mori.com/newsevents/latestnews/newsitemdetail.aspx?oItemId=531

http://www.ipsos-mori.com/newsevents/latestnews/newsitemdetail.aspx?oItemId=531

Germany and Japan - Canaries in the 'Demographic' Minefield

An interesting article in Der Spiegel notes the 'skilled worker shortage' challenge Germany faces as its economy recovers. http://www.spiegel.de/international/germany/0,1518,711046,00.html

There are other developed countries (along with the biggest developing country - China) that face similar demographic challenges down the road. The following figures (source: Statistical Handbook of Japan 2009) highlight the challenges facing some key economies.

Germany and Japan are not known for throwing out the welcome mat to new immigrants. This creates a quandary for their policymakers as these two major economic powers struggle to retain their economic clout in a world of rapid change and shifting demographics.

Both Germany and Japan are famous for their strong export performance (and sustained trade surpluses). However, a critical challenge facing both countries is the rapid aging of the population and the relatively low birth rate. Longer-term, the demographic shift is likely to impact the level of saving and trade surpluses in both countries.

Japan is certainly an extraordinary case study. According to the Statistical Handbook of Japan 2009, the population of Japan peaked at 127.84 million in Dec 2004. The total population has been in decline ever since. The following figure (from Statistical Handbook of Japan 2009) highlights the challenges Japan faces as the ratio of retirees to working adults rises dramatically.

There are other developed countries (along with the biggest developing country - China) that face similar demographic challenges down the road. The following figures (source: Statistical Handbook of Japan 2009) highlight the challenges facing some key economies.

Germany and Japan are not known for throwing out the welcome mat to new immigrants. This creates a quandary for their policymakers as these two major economic powers struggle to retain their economic clout in a world of rapid change and shifting demographics.

The Great Recession - Was it Good for You?

David Leonhardt of the New York Times has an interesting piece that highlights the fact that the impact of the recession was not evenly distributed.

"For Those With Jobs, a Recession With Benefits" by David Leonhardt (New York Times)

Geography of the Recession:

Geography of a Recession

Geography of a Recession

Businessweek looks at the labor market for young workers:

FOMC Statement

The most interesting bit from yesterday's Fed statement:

"To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal Reserve's holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities. The Committee will continue to roll over the Federal Reserve's holdings of Treasury securities as they mature".

During the financial crisis the Fed dramatically expanded its balance sheet. A good description of Fed actions is provided here http://research.stlouisfed.org/publications/review/09/03/Gavin.pdf.

The chart (data from Cleveland Fed) below highlights recent changes in Fed's balance sheet. As the Fed plans to keep its total level of securities' holdings at the current elevated levels (and increases the fraction going to long-term treasuries), it leads one to wonder about the consequences two or three years down the road.

"To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal Reserve's holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities. The Committee will continue to roll over the Federal Reserve's holdings of Treasury securities as they mature".

During the financial crisis the Fed dramatically expanded its balance sheet. A good description of Fed actions is provided here http://research.stlouisfed.org/publications/review/09/03/Gavin.pdf.

The chart (data from Cleveland Fed) below highlights recent changes in Fed's balance sheet. As the Fed plans to keep its total level of securities' holdings at the current elevated levels (and increases the fraction going to long-term treasuries), it leads one to wonder about the consequences two or three years down the road.

Tuesday, August 10, 2010

Economic Update

Is the risk of a double-dip recession increasing?

According to a piece written by economists at the Federal Reserve Bank of San Francisco,

"An unstable economic environment has rekindled talk of a double-dip recession. The Conference Board's Leading Economic Index provides data for predicting the probability of a recession but is limited by the weight assigned to its indicators and the varying efficacy of those indicators over different time horizons. Statistical experiments with LEI data can mitigate these limitations and suggest that a recessionary relapse is a significant possibility sometime in the next two years".

http://www.frbsf.org/publications/economics/letter/2010/el2010-24.pdf

Productivity Growth

US productivity growth appears to be easing. A factor behind the low levels of private sector hiring has been the impressive labor productivity growth seen during the past year. While in the long-run high productivity growth is enormously beneficial, it can, however, deter job market growth in post recession recovery periods. Today's data (graphs shown below is from the BLS http://www.bls.gov/news.release/pdf/prod2.pdf) indicates that for the most recent period productivity growth actually dipped a bit (-0.9%). Will the labor market start improving?

Also, interestingly, unit labor costs have stopped declining. Is the Fed paying attention?

Miscellaneous:

Renowned international trade economist, Jagdish Bhagwati, has an interesting piece in today's Financial Times on America's push to raise the profile of its manufacturing industry.

http://www.ft.com/cms/s/0/54a03eb6-a3eb-11df-9e3a-00144feabdc0.html (requires registration)

US debt load among the worst

http://online.wsj.com/article/federation_feature.html

According to a piece written by economists at the Federal Reserve Bank of San Francisco,

"An unstable economic environment has rekindled talk of a double-dip recession. The Conference Board's Leading Economic Index provides data for predicting the probability of a recession but is limited by the weight assigned to its indicators and the varying efficacy of those indicators over different time horizons. Statistical experiments with LEI data can mitigate these limitations and suggest that a recessionary relapse is a significant possibility sometime in the next two years".

http://www.frbsf.org/publications/economics/letter/2010/el2010-24.pdf

Productivity Growth

US productivity growth appears to be easing. A factor behind the low levels of private sector hiring has been the impressive labor productivity growth seen during the past year. While in the long-run high productivity growth is enormously beneficial, it can, however, deter job market growth in post recession recovery periods. Today's data (graphs shown below is from the BLS http://www.bls.gov/news.release/pdf/prod2.pdf) indicates that for the most recent period productivity growth actually dipped a bit (-0.9%). Will the labor market start improving?

Also, interestingly, unit labor costs have stopped declining. Is the Fed paying attention?

Miscellaneous:

Renowned international trade economist, Jagdish Bhagwati, has an interesting piece in today's Financial Times on America's push to raise the profile of its manufacturing industry.

http://www.ft.com/cms/s/0/54a03eb6-a3eb-11df-9e3a-00144feabdc0.html (requires registration)

US debt load among the worst

http://online.wsj.com/article/federation_feature.html

Monday, August 9, 2010

Interesting Videos

Ex-Treasury Secretaries Discuss Direction of US Economy on Zakaria’s GPS

Policymaking in the World’s Leading Democracy:

What it takes to pass a major legislative bill (healthcare bill) in the US:

Related Note:

(Bryan Caplan’s “The Myth of the Rational Voter” is worth reading for those who wonder about how democracies and voters function in the real world: http://www.cato.org/pubs/pas/pa594.pdf)

A Few India Related Items

On the Indian Economy:

On Tourism:

Can India match East Asia as a manufacturing powerhouse?

India gearing up for growth

Rupee Symbol

Japan Invests In Indian Autos

India's Secret Sauce

On International Affairs:

The Return of the Raj by C. Raja Mohan

Beautiful South India

Long Term Consequences of Major Financial Crises

An Age of Diminished Expectations? By Kenneth Rogoff

Japan’s Lost Decade and its Effects

July 2010 Labor Market Data

According to the Bureau of Labor Statistics, so far this year, private sector employment has increased by 630,000 (with about two-thirds of the gain occurring in March and April). The long-term unemployed (those out of work for longer than 26 weeks) is near 45%.

My Brief Take on Labor Market Conditions:

As the effects of government census hiring/firing on payroll employment diminishes, the strength of the private sector hiring is going to be extremely critical. It is important to note that the pace of job growth needs to be rapid enough to (a) absorb those who lost their jobs during the recession (totaling around 8.4 million), and (b) provide employment for new entrants (arising from population growth and demographic shifts).

It is also worth noting that the size of the labor force may shift as some of the 'discouraged workers' return to seek employment as the economic recovery progresses. This may cause a temporary spike in the reported monthly unemployment rate.

My Brief Take on Labor Market Conditions:

As the effects of government census hiring/firing on payroll employment diminishes, the strength of the private sector hiring is going to be extremely critical. It is important to note that the pace of job growth needs to be rapid enough to (a) absorb those who lost their jobs during the recession (totaling around 8.4 million), and (b) provide employment for new entrants (arising from population growth and demographic shifts).

It is also worth noting that the size of the labor force may shift as some of the 'discouraged workers' return to seek employment as the economic recovery progresses. This may cause a temporary spike in the reported monthly unemployment rate.

US Consumers

Characterizing American spending behavior of late:

The New Abnormal (Businessweek)

http://www.businessweek.com/magazine/content/10_32/b4190050473272.htm

The New York Times gets philosophical about consumption:

But Will It Make You Happy?

http://www.nytimes.com/2010/08/08/business/08consume.html

The New Abnormal (Businessweek)

http://www.businessweek.com/magazine/content/10_32/b4190050473272.htm

The New York Times gets philosophical about consumption:

Interesting New Books

Fault Lines: How Hidden Fractures Still Threaten the World Economy by Raghuram Rajan

An interesting look at the fundamental factors that led to the Global Credit Crisis of 2008-2009. Key Insight: During the past couple of decades, US policymakers encouraged rapid credit growth as a "palliative" to the growing inequality and meager real income growth experienced by a majority of Americans.

Listen to NPR Planet Money (Deep Read Series) Interview with Prof. Rajan:

http://www.npr.org/blogs/money/2010/06/24/128089847/deep-read-let-them-eat-credit

Also, check out Rajan's prescient article from 2005: "Has Financial Development Made the World Riskier?":

http://www.kansascityfed.org/publicat/sympos/2005/pdf/rajan2005.pdf

From Poverty to Prosperity: Intangible Assets, Hidden Liabilities and the Lasting Triumph over Scarcity by Arnold Kling & Nick Schulz

Fascinating collection of interviews with eminent economic growth specialists.

Left Behind: Latin America and the False Promise of Populism by Sebastian Edwards

An examination of recent political and economic developments in Latin America by a leading economist.

An interesting look at the fundamental factors that led to the Global Credit Crisis of 2008-2009. Key Insight: During the past couple of decades, US policymakers encouraged rapid credit growth as a "palliative" to the growing inequality and meager real income growth experienced by a majority of Americans.

Listen to NPR Planet Money (Deep Read Series) Interview with Prof. Rajan:

http://www.npr.org/blogs/money/2010/06/24/128089847/deep-read-let-them-eat-credit

Also, check out Rajan's prescient article from 2005: "Has Financial Development Made the World Riskier?":

http://www.kansascityfed.org/publicat/sympos/2005/pdf/rajan2005.pdf

From Poverty to Prosperity: Intangible Assets, Hidden Liabilities and the Lasting Triumph over Scarcity by Arnold Kling & Nick Schulz

Fascinating collection of interviews with eminent economic growth specialists.

Left Behind: Latin America and the False Promise of Populism by Sebastian Edwards

An examination of recent political and economic developments in Latin America by a leading economist.

Subscribe to:

Comments (Atom)